1. Self Employed

Normal Place or base of work

The first thing you need to think about is your normal place of work, so that you can work out what is your ordinary commute which is disallowed. If you rent an office or workspace anywhere then that generally be your normal place of work. If you mainly work from home then that will usually be your normal place of work. If you don’t rent space and are generally out and about e.g. plumber or handyman, then your base might also be home. This will be relevant if you are claiming use of home as an office as part of your expenses.

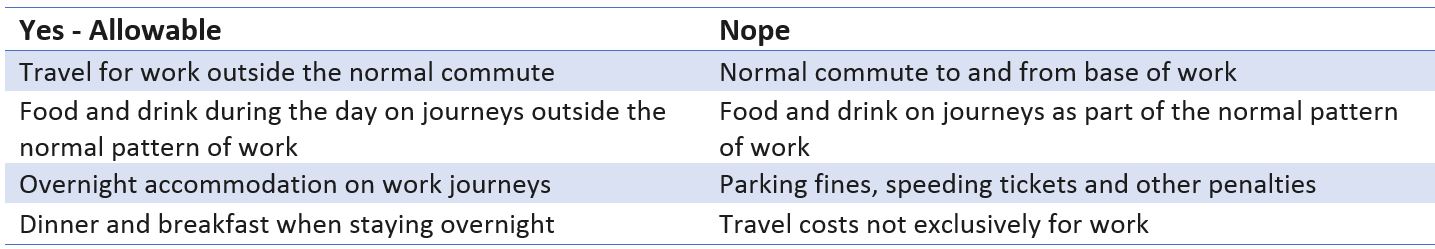

Travel Expenses

You can’t include any expenses for your journey between your home and base of work – this is part of your ordinary commute. Other travel outside the ordinary commute is generally allowed as long as it is “wholly and exclusively” for work purposes. You can claim motor expenses either by mileage or full cost. You can also claim other travel expenses such as airfares, rail, taxis, bus, congestion charge, toll charges and parking costs.

Meals

“Everyone must eat to live” says the tax office, which means that in general you can’t claim your daily meals or coffee runs as a business expense. However, there is recognition that meals while out and about traveling can end up costing more. It all comes down to…is the journey infrequent & outside your normal pattern of work? e.g. a plumber travels and works out and about at various client sites. The travel costs are allowable but lunch is not because it is part of their normal work pattern.

If the journey is more of a one-off then you can include meal expenses during the day e.g. Graphic designer usually working from home can include both travel and meals costs for a whole day out at a conference.

Staying away

If your business requires a trip with an overnight stay then you can claim for the cost of the accommodation and reasonable expenses for the evening meal and breakfast.

Warning– anything claimed for locations too close to your base of work might not be considered to be subsistence. Also remember – HMRC guidance says reasonable costs and alcohol is not subsistence unless it is purchased with a meal and even then it must be reasonable e.g. one drink or half a bottle of wine, so no buying the rounds for everyone and expensing it!

2. Limited Company- Directors and employees

Being an employee

If you are the director of your own Limited Company then in terms of expenses you are considered an employee. As an employee you can claim your travel and subsistence expenses from the company and be reimbursed.

Permanent v. temporary workplace

An employee will have a permanent workplace and can actually have more than one permanent workplace. Anywhere that you work regularly e.g. at least once a week, on a long-term basis is a permanent workplace. Travel to and from your permanent workplace is classed as your ordinary commute which is not an allowable expense.

If you are going somewhere to carry out a short-term task then it is a temporary workplace. If the task you are going to do lasts more than 2 years plus you are spending more than 40% of your time there, it becomes a permanent workplace and part of the ordinary commute (see HMRC).

The rules relating to temporary and permanent workplaces are actually quite complicated, so if your situation is not straightforward e.g. IT contractors, then talk to us here at LeeP Accountants.

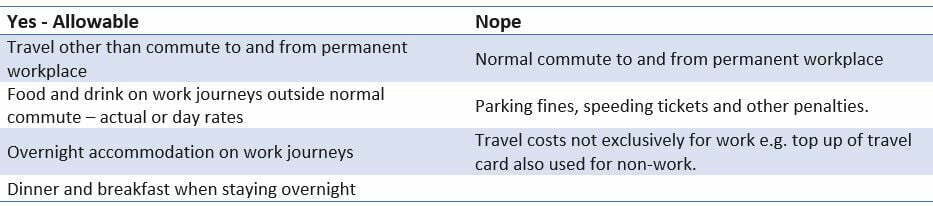

Travel

Like for the sole-trader, travel costs for the ordinary commute to and from your permanent workplace are not allowed. Other travel outside the ordinary commute is generally allowed provided it is wholly and exclusively for work purposes. You are allowed travel costs to a temporary workplace where it costs you more than your normal commute.

Again, you can claim motor expenses either by mileage or full cost. You can also claim other travel expenses such as airfares, rail, taxis, bus, congestion charge, toll charges.

Meals

Meal expenses for employees are allowed where they are necessary and incurred in the course of the job . This does give a bit more leeway than for a sole trader. However, this is an extremely subjective area and certainly not black and white

Lunch bought at motorway services or a train station for a one-off journey will be OK as you are obviously traveling and having to pay extra because of it.

Meal day rates v. actual costs

Meal expenses can be charged as they are incurred, based on the actual receipt amount OR HMRC has benchmark scale rates for subsistence expenses that can be used instead. These benchmark rates can be useful if you are going to be working away a lot of the time as it can simplify things and does not require processing so many individual receipts.

Remember you can only use one scheme or the other. If you are going to use actual subsistence expenses then you must save receipts and if you are going to use benchmark rates then you must apply to HMRC first.

Overnight accommodation

If your business requires a trip with an overnight stay then you can claim for the cost of the accommodation and reasonable expenses for the evening meal and breakfast. Beware – anything claimed for locations too close to your base of work might not be considered to be subsistence. Also bear in mind that the HMRC guidance says reasonable costs.

The basics to remember across the board are business costs only and generally only food if you are not in your normal pattern of work or are staying overnight.

For more advice and guidance call LeeP Accountants on 01733 699033